Exploration 2017 v 2019: Partridge v Goose

Azinor Catalyst UK returns to the open market with an exciting prospect named ‘Goose’ targeting 71 MMBOE recoverable.

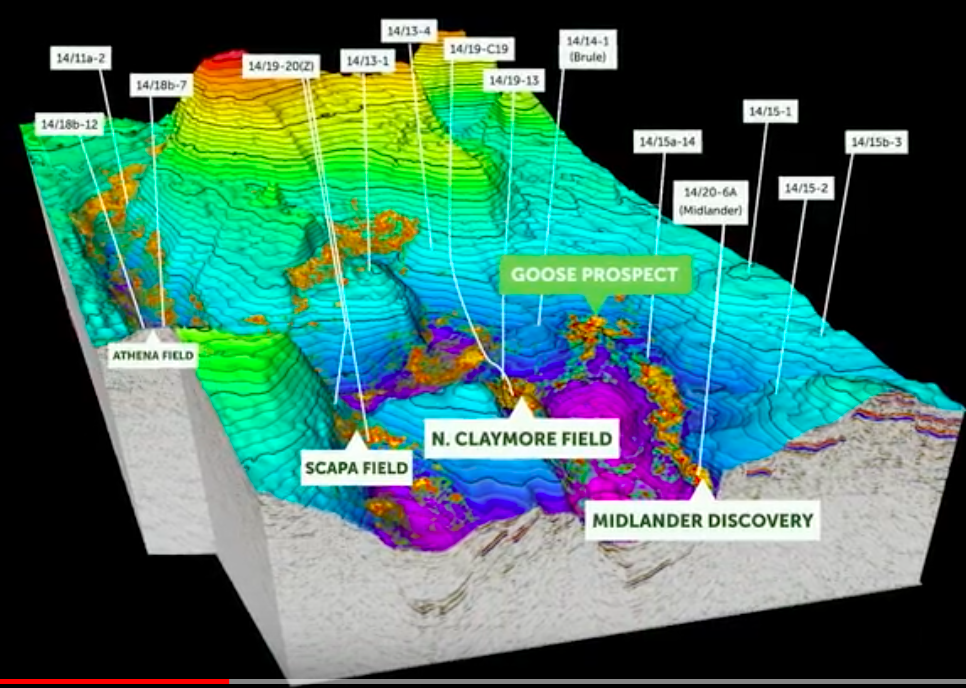

Fig. 1 BCU structure map with well annotations and the Scapa Sandstone EEI superimposed: part block 14/14b-KL6 Goose is adjacent to, and up-dip of, an oil discovery made in Scapa sandstone reservoir in well 14/20-6A (Midlander). Azinor Catalyst UK

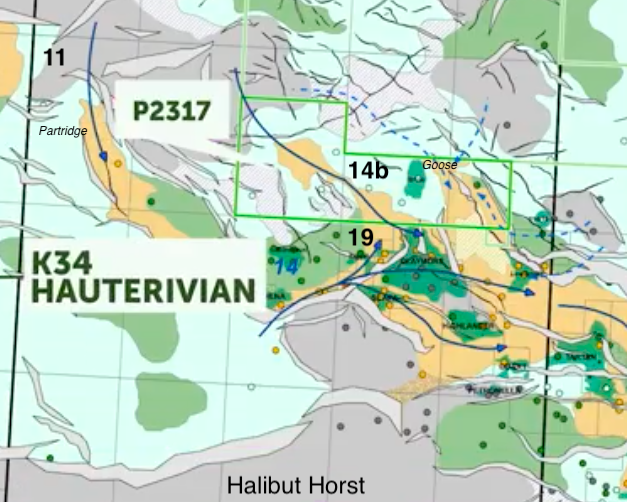

Goose is located in Witch Ground Graben (WGG) in part block 14/14b. Goose, sometimes referred to as the KL6 prospect, is targeting the K34 sandstone play fairway and the Scapa Sandstone Formation in which prolific oil discoveries have been made.

The nearby North Claymore Field has 164 MMBOE recoverable.

In 2017, Azinor sole risked the drilling of the Partridge prospect, well 14/11a-2. Partridge is located up-dip of the WGG in the Jura sub-basin. Partridge is situated on the North Halibut shelf but on the south flank of a massive structural high, named by Azinor as the Lawlor High, where Permian sub-crops the Chalk. (Reference 1)

Targeting the Hauterivian, the well successfully discovered sandstone. Azinor had evidently cracked the code for accurate prediction of the K34 play fairway reservoir presence. But in this case, the sandstone was water wet.

Reservoir juxtaposition against older sandstones (intra-Devonian?) on the High may be the cause of trap failure at Partridge.

Fig. 2 Part blocks 14/19 and 14/14b, K34 Hauterivian Scapa reservoir play fairway map. Azinor Catalyst UK

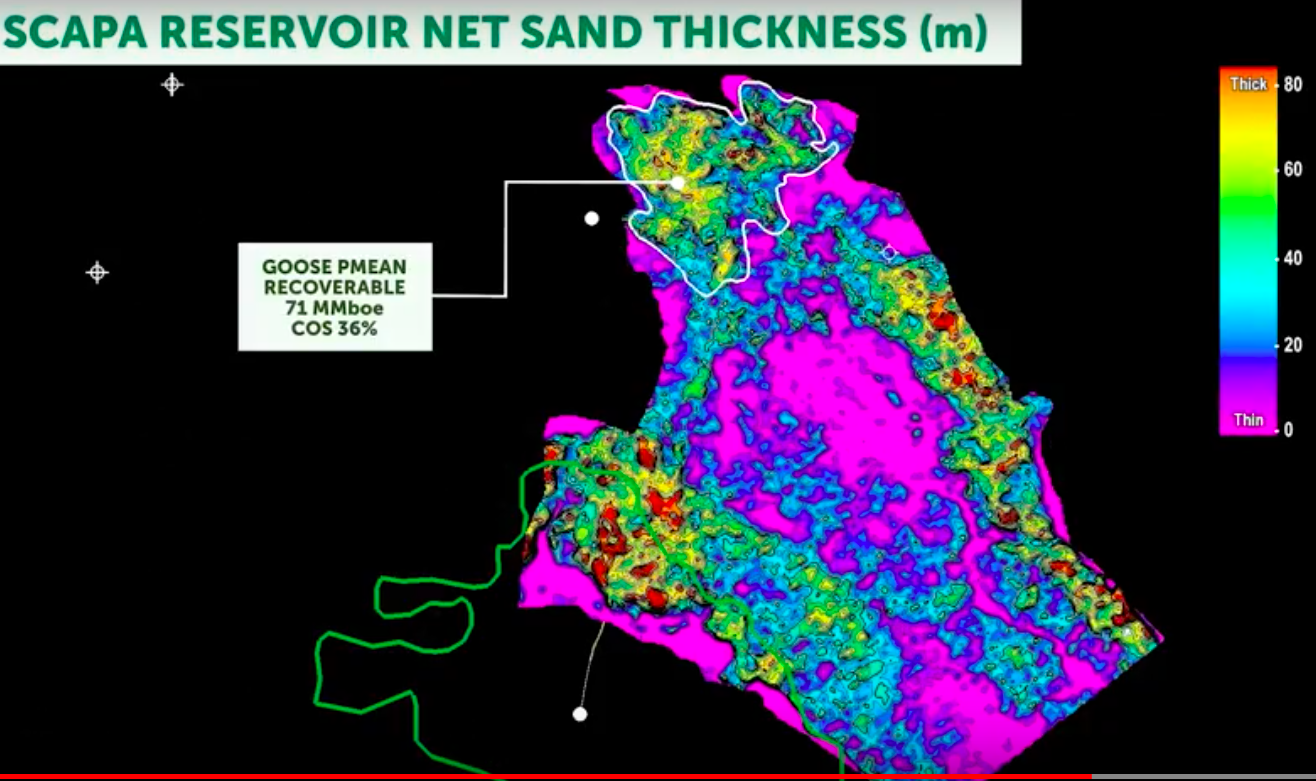

The Scapa reservoir net sand thickness in the prospective area, part blocks 14/19 and 14/14b, ranges between 0 and 85m.

Fig. 3 Part blocks 14/19 and 14/14b Scapa reservoir net sand thickness map. Azinor Catalyst UK

Goose has a Prospective Resource Pmean of 71 mmboe and the P90 to P10 range is 30 to 121 mmboe.

| 14/14b-KL6 Goose Prospect | ||||

| Prospective Resources (mmboe) | ||||

| P90 | P50 | Pmean | P10 | GCoS |

| 30 | 63 | 71 | 121 | 35% |

| Source: | Azinor Catalyst UK | |||

| Licence | P2317 | |||

| Table 1: | Goose prospect prospective resources. | |||

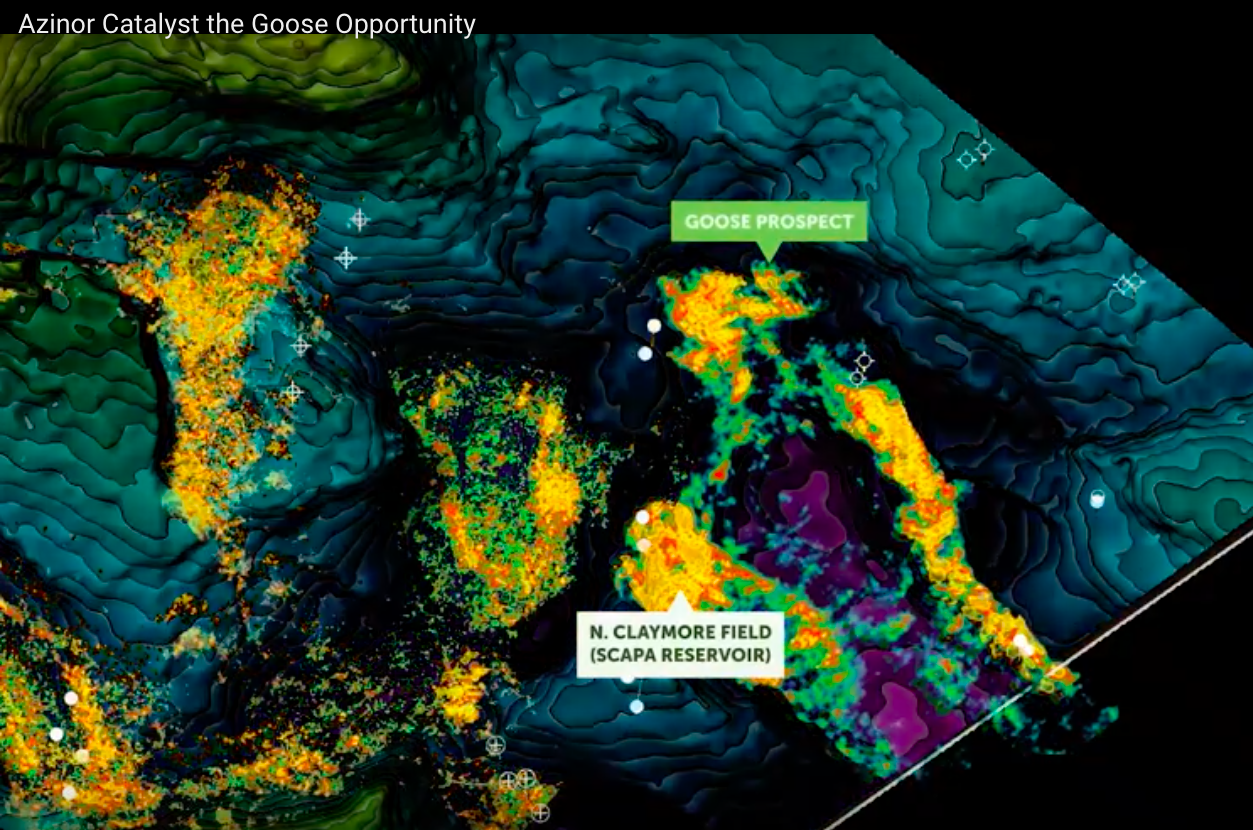

Fig. 4 Part blocks 14/13, 14/14b and 14/19, 14/20 Scapa reservoir Extended Elastic Impedance (EEI) superimposed on the Base Cretaceous structure map. Azinor Catalyst UK

Azinor has decided not to sole risk Goose and it wants to share the exploration risk. The Dry hole well cost is estimated at US$11 million. Azinor UK has 80% in P2317 and a material interest is available.

To aid marketing of the Goose business opportunity, Azinor Catalyst UK has released a YouTube video in which their Technical Director, Henry Morris, describes the prospect in more detail. (Reference 2)

Prediction of the GCoS at Goose will however still remain with the subsurface interpretation. Here the role of the Geoscientist is of paramount importance.

In this quest, a closer look at the Broadband 3D data sets, and a more investigative approach to the full stack versus near-, mid- and far- stacks, coupled with well rock physics is required. Only after that work is carried-out by the prospective farm-in company, will any reasons be identified to rethink the GCoS. The evaluation may then reveal potential ‘show stoppers’ to the drilling of this exciting prospect.

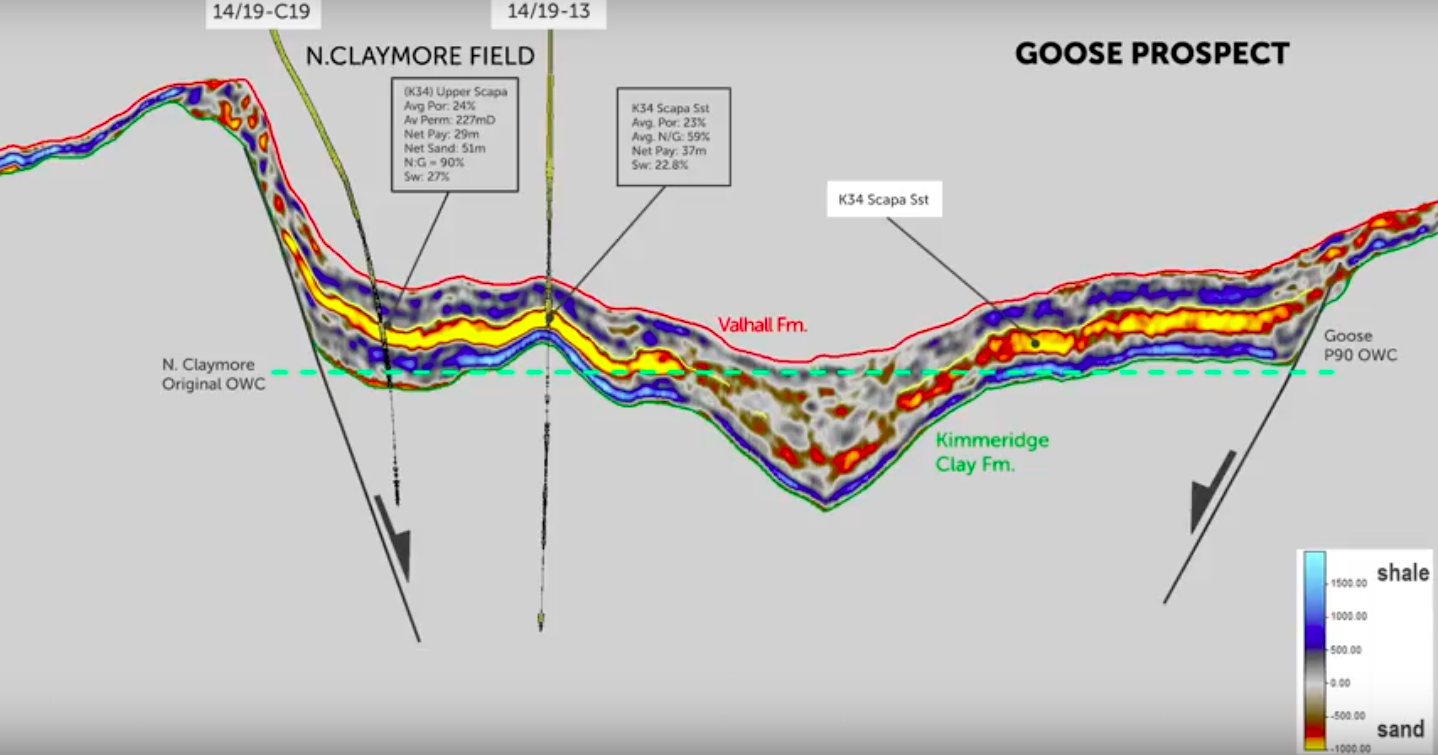

Fig. 5 Seismic dip section with an impedance attribute, of the Early Cretaceous interval top Valhall to BCU, between North Claymore and Goose Prospect 14/14b-KL6 – Azinor Catalyst UK

Throughout 2017 and 2018, we have witnessed changes in the ownership and operatorship of ageing oilfields on the UKCS.

Now in 2Q-3Q 2018, we are witnessing a new Exploration approach to attracting financial investment of drilling exploration prospects in the mature sub-basins of the UKCS. Reference 2

This is in accordance with the recommendations outlined in the Wood Review Report published on 24 February 2014. Reference 3

- Develop and implement important Sector Strategies.

The new body should work with Industry to develop and implement the six sector strategies outlined in the Wood Review (covering exploration, asset stewardship, regional development, infrastructure, technology and decommissioning), along with suggested actions.

Through the use of online video, we must commend Azinor Catalyst UK for introducing a ‘radical change’ to the promotion of UKCS farm out opportunities. Reference 2

In 3Q2018, we are at a crossroads in the revival of North Sea exploration. The oil price appears to being sustained at or around $70 barrel. Hopefully, Company budgets allocated to Exploration are being reviewed upwards for 2019.

Only then will the upstream industry witness an increasing requirement for geoscientists to return to the industry to mature the leads and prospects that sit on companies prospect inventories to the drillable stage.

John Wood 11.09.2018

References:

- UK Offshore, Azinor 2019 Drilling Campaign, Farm-out Opportunity Report 9 August 2018, Westwood Global Energy Report

- YouTube Video: https://www.youtube.com/watch?v=l7hH2Mrzuek

- https://www.ogauthority.co.uk/about-us/what-we-do/the-wood-review/

Figures:

Fig. 1 Block 14/14b-KL6 Goose is adjacent to, and up-dip of, an oil discovery made in Scapa sandstone reservoirs in well 14/20-6A (Midlander). Azinor Catalyst UK

Fig. 2 Part blocks 14/19 and 14/14b, K34 Hauterivian Scapa reservoir play fairway map. Azinor Catalyst UK

Fig. 3 Part blocks 14/19 and 14/14b Scapa reservoir net sand thickness map. Azinor Catalyst UK

Fig. 4 Part blocks 14/13, 14/14b and 14/19, 14/20 Scapa reservoir Extended Elastic Impedance (EEI) superimposed on the Base Cretaceous structure map. Azinor Catalyst UK

Fig. 5 Seismic dip section with an impedance attribute, of the Early Cretaceous interval top Valhall to BCU, between North Claymore and Goose Prospect 14/14b-KL6. Azinor Catalyst UK

Note: These figure images are sourced from the YouTube video marketed by Azinor Catalyst UK